NEWS

Arc & Co. Completes £16.2m loan with Brydg Capital

Edward Horn-Smith has completed a £16.2m bridging loan for a newly completed block of apartments in Ealing.

The original development loan was structured with senior and mezzanine loans, which Arc & Co. were able to restructure and simplify with a 80% LTV bridge.

The £16.2m bridging loan was provided by Brydg Capital and will allow the developer to finish the build after unforeseen delays as well as providing an extended sales period. The loan was provided at a rate of 7.25% pa.

Edward Horn-Smith, Managing Director at Arc & Co. says, “It was important to provide the borrower with a new facility that enabled them to finish the build and allow time to sell the properties at a rate that wouldn’t dramatically erode the developer's profits.”

Aysan Pamir Ozel, Head of Business Development at Brydg Capital added, “Brydg always strives to support developers in preserving profit through a constantly evolving economic climate. We continue to work closely with sophisticated debt advisors like Arc & Co. in this pursuit and are continuously impressed by Ed’s ability to present well structured transactions.”

ARC & CO. COMPLETES £68M DEVELOPMENT FACILITY

Edward Horn-Smith and Cameron Hayes at Arc & Co. have completed a £68m development facility with Oaktree-backed lender, Silbury Finance.

The development is being brought forward by London developer Avanton, as part of a joint venture with Housing Growth Partnership. The development of 262 residential units marks the start of Avanton’s masterplan for the Old Kent Road area, aligned with Southwark and the GLA’s aims to deliver 20,000 new homes, workspaces and schools. Avanton are playing a key role in this regeneration, bringing several developments forward over the next few years.

Following a short but thorough tender process; Arc & Co. secured senior debt from Silbury, who were able to structure fixed rate market leading terms.

Edward Horn-Smith, Managing Director at Arc & Co. says, “We are very happy to be partnering with clients like, Avanton, who are pushing the envelope to deliver well-designed, competitively priced residential schemes and are ahead of the curve in unlocking new parts of London. They are a strong developer with a robust track record in London and we look forward to growing the relationship.”

Arc & Co. worked closely with the client on this to secure the site on an initial bridge loan earlier this year to finalise planning.

Cameron Hayes, Asset Finance Advisor at Arc & Co. says, “Working with an institutional partner like Silbury was fundamental to the successful launch of this scheme in partnership with Avanton and Housing Growth Partnership. Given the size of the project and prospective tenor, Arc & Co. were able to agree pricing on a fixed-rate basis to help protect the client against further cost increases and interest rate rises.”

Arc & Co. structures £20.84m, debt & equity funding for acquisition of residential block

Philip Kay, Senior Asset Finance Advisor at Arc & Co. has completed £20.84m across two loans (Both debt & equity) for the acquisition of a residential block in Borehamwood. Post-acquisition, the developer client will apply for planning permission to add additional units to the existing scheme.

The senior investment loan of £12m is being provided by Aldermore at a 70% LTV on a 5-year fixed interest rate. The additional funds for £8.3m are structured as a second charge loan with a profit share element. The specialist development funder in question was comfortable to accommodate the planning risk in the scheme, given the strong location and the developer’s track record.

Philip Kay says “This is a well-located residential asset which our developer client has identified for its upsizing potential in the local market. The resulting scheme will complement the local area and we look forward to working on the development facility once planning for the additional units is granted. I’d like to thank both lenders for their support on this transaction.”

Ian Sutton from Aldermore says, “It is an exciting deal with Aldermore providing the senior debt enabling the acquisition of a quality residential asset, it was an excellent collaborative approach from all parties and great to be involved. We feel the asset has great potential to add value through development and look forward to supporting the development in the future. The deal showcases Aldermore’s ability to create long-term funding partnerships aligned to borrower strategy and brilliantly demonstrates our bespoke and flexible approach, combining both investment and development finance. Special thanks to Philip Kay of Arc & Co. for the introduction.”

Arc & Co. structures £15.6m development loan with CapitalRise for the development for 5 exclusive houses in Surrey

Cameron Hayes, Asset Finance Advisor at Arc & Co. has arranged a £15.6m development loan with leading specialist prime property lender CapitalRise, for the acquisition and development of five luxury houses on a 27-acre site in Farnham, Surrey, on an exclusive gated parkland. The scheme has a GDV of £31.57m with an additional 1.8m mezzanine, taking the total loan amount to 17.4m.

There were several challenges to overcome in order to secure the required gearing, specifically to do with ongoing market issues relating to build costs. Extra emphasis was placed on due diligence for the scheme including understanding the complexity of the development appraisal, given the prime value of the properties and the developers delivery team to ensure the scheme would be built on time and within budget to mitigate any potential issues. CapitalRise’s experience and breadth of knowledge in understanding this sector made them the ideal lender to partner with.

Commenting Katy Katani, Associate Director at CapitalRise, said: “We are extremely proud and delighted to be working on one of the most impressive developments in Surrey backed by such exceptional developers. We are well known for funding loans for property projects in Prime Central and Outer London but have also been assisting developers to deliver properties in the Home Counties for many years. A region where we continue to expand our remit.

We worked very closely with Arc & Co in order to construct a tailored package for the client and look forward to overseeing this development progress.”

Commenting Cameron Hayes, Asset Finance Advisor at Arc & Co. said: “Katy and the team at Capital Rise were a pleasure to work with. Their experience in super prime assets was crucial to delivering this deal. All parties were very cooperative and worked with speed to deliver this on time and we are delighted to have completed this on behalf of our client.“

Arc & Co. arranges £5m development facility with Blend Network

Cameron Hayes, Asset Finance Advisor in the Structured Finance team has completed a £5m residential development facility with Blend Network.

The loan was a for the conversion of a small holding with outer barns in Surrey. The loan was a refinance of an existing bridge, to release equity from planning uplift and to complete the development of the farmhouse and outer buildings. The loan was agreed at 70% LTGDV and 130% loan to purchase price (based on the original acquisition). The client‘s strategy was to maximise the day one land loan to release equity for upcoming purchases.

Paul Watson, Head of Lending at Blend Network said “We are delighted to have closed a £5m loan which was introduced by Cameron Hayes. The entire deal process was seamless with advisor and borrower alike and we are delighted to complete in a swift manner with a top tier SME client. Hopefully the first of many more to follow!”

Cameron Hayes says, “Delighted to have completed on this with Paul, Danny and the team at Blend Network. This is a very exciting development and the first stage in a much wider development of the site.”

Arc & Co. structures £17.34m bridge loan provided by GRE finance to fund share buyout of family-owned property company

Philip Kay, Senior Asset Finance Advisor at Arc & Co. has advised family-owned property company Kingscastle on a £17.34m loan. The senior bridge loan has been provided by specialist bridge lender GRE Finance, to fund the share buyout of a significant UK real estate portfolio and was secured against 76 UK properties valued at £29.2m.

The portfolio consists of 51 commercial and 25 residential properties and represents excellent diversification due to the spread of asset types, locations and values. 55% of the assets are in London and the South East with 21% in the North East of England and the remainder in Manchester, the Midlands, the South Coast, South West and Yorkshire.

The senior loan of £17.34m is being provided by GRE Finance at a 61% LTV on a 12-month term.

Philip Kay, Senior Asset Finance Advisor at Arc and Co. said:

“GRE really outperformed in getting this loan completed in a short timeframe. The loan from GRE was the largest of three loans which together funded the share buyout and was therefore critical to the entire transaction for the client. GRE adopted a commercial approach when faced with complexities in the transaction. I look forward to introducing more transactions to them in due course.”

Daniel Benton from GRE Finance said:

“Kingscastle is an extremely experienced property developer with significant experience of managing large property portfolios. This portfolio is well structured given its significant diversity of assets, providing good liquidity and protection to withstand exposure to a particular location or asset class. It was a pleasure to work with Arc & Co. and Kingscastle on this transaction.”

GRE Finance was advised by Fladgate LLP.

Arc & Co. secures £3.7M investment loan for a 53 bed scheme in Nottingham

Julian King, Director within the structured finance team at Arc & Co. has secured a £3.7m investment loan for his client, a Hong Kong based investor to refinance a 53 bed student block in the centre of Nottingham. There were several constraints in completing the facility given the offshore structure of the borrower which were navigated to structure a suitable debt facility.

Julian King added “This is the third transaction I’ve been involved in with my client having previously structured finance for two previous developments in London. Its great working with the team and to look at their wider investment portfolio as the company grows and to be involved in their overall corporate debt strategy”.

The £3.7m investment loan was provided by Secure Trust Bank, to aid with the refinance of the outgoing lender and to provide certainty within the investment portfolio in these uncertain times. The loan was provided for a period of 5 years at a fixed interest of 3.99% p.a at a 65% LTV.

David Burke, Lending Director at Secure Trust Bank said “This is our second deal with the client, who continues to be well represented by Julian King at Arc & Co. The case involved several complexities however all parties worked together extremely hard to get the deal over the line within a very short timescale. We are delighted to be able to continue to support existing clients and we are looking forward to building on the foundations of this existing relationship.”

Secure Trust Bank was advised by Clarke Willmott with the client being advised by Gunner Cooke, both of whom did an excellent job in getting the loan completed within a tight timeframe of 6 weeks, in which to secure the terms under the loan.

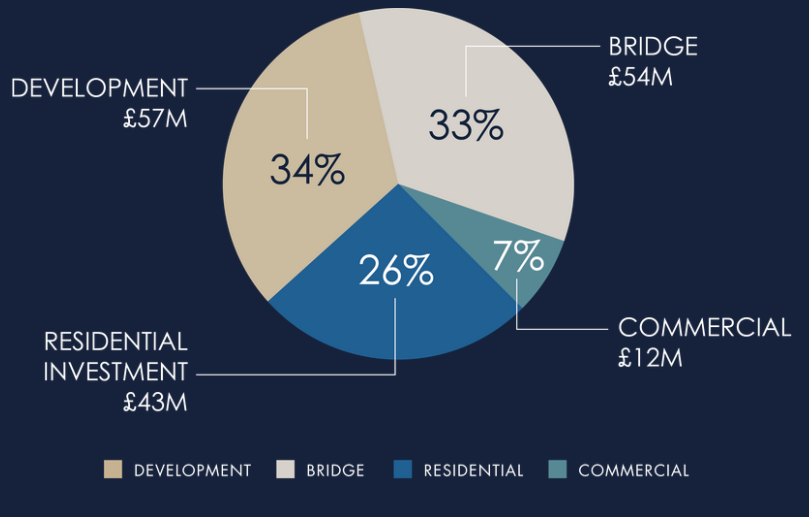

Arc & Co. Company Update: £165m of loans completed

After a successful start to the year, we wanted to take the time to celebrate recently completed deals. Arc & Co. has completed on over £165m of lending, advising on 76 transactions in the first four months.

We are also hugely pleased to have won Best Development Broker at the Moneyfacts awards.

Thank you for your continued support.

Andrew Robinson

Chief Executive Officer

Arc & Co.

Recent Deal Completions

Residential development - Site Acquisition

Loan Size: £12.2 million

Lender: Market Financial Solutions

South East

Finance Advisor: Edward Horn-Smith

Residential development – Site Acquisition

Loan Size: £11.9 million

Lender: Market Financial Solutions

South London

Finance Advisor: Cameron Hayes

Mixed Use – Equity Release to enable energy efficient upgrades

Loan Size: £11.5 million

87% LTGDV

Lender: Interbay Commercial

Lambeth, London

Finance Advisor: Matthew Yassin

Residential development – Pre Planning Development Loan

Loan Size: £10 million

85% LTGDV

Lender: Close Brothers

South East London

Finance Advisor: Matthew Yassin

Office Refurbishment – Site acquisition

Loan Size: £5.2 million

70% LTV

Lender: Topland

Fitzrovia, London

Finance Advisor: Tom Savill and Tom Stephenson

Residential development – Site acquisition for 6 apartments and 3 townhouses

Loan Size: £5.4 million

£8.5 million GDV

Lender: Hampshire Trust Bank

Southwark, London

Finance Advisor: Julian King

Prime Residential – Two bridging loans with Century Capital

Loan Size: £2.1 million and £1.5 million

66% LTV and 30% LTV

Lender: Century Capital

Knightsbridge and Oxford

Finance Advisor: Nikita Nigai

Arc & Co. win Development Finance Broker of the Year at the Business Moneyfacts Awards 2022

On Thursday night in the presence of more than 900 industry professionals from leading financial institutions and trade bodies at Evolution London, the winners of the 2022 Business Moneyfacts Awards were announced.

For the fourth time in six years, Arc & Co. Structured Finance were presented with the Development Finance Broker of the Year award. Thanks to diligent research by Moneyfacts and industry experts, companies and brokers who won, or received highly commended or commended trophies, are considered to be truly the best in class.

Andrew Robinson, CEO of Arc & Co. said: “it’s an absolute privilege to have won this award for a fourth time. It reflects the effort, professionalism and hard work of the team over the past 12 months and we hope to be back next year with another strong submission”

Lee Tillcock, Editor of Business Moneyfacts, said "Following a period of previously unprecedented uncertainty and subsequent change the last year has provided ongoing challenges to the economy and the business sector. Fighting hard to shake off the effects of COVID-19, businesses, brokers and providers have worked tirelessly to boost business opportunities. The finalists and eventual winners at this year’s awards should be rightly proud of their achievements and have offered a range of products and services that have best supported the sector, at a time when its success and growth remain ever vital to the recovery of the wider economy.”

Georgie Crocker Joins Arc & Co. as Broker

Georgie Crocker joins Arc & Co. from FinTech brokerage, Capitalise, where she was predominantly focused on structured finance advisory. Her experience spans real estate across a variety of sectors including logistics/industrials, residential, student, office, hotel and retail.

Georgie Crocker, Broker at Arc & Co. says, ‘I am excited to be joining the Arc & Co. team with the experience and reputation within the development and commercial sector across all Real Estate asset classes’

Andrew Robinson CEO of Arc & Co. ‘I am very excited to be working with Georgie, she has a vast knowledge of the Commercial and Development Market and is very driven to provide clients with best advice. Georgie is joining Arc & Co. at a very good time where the board and management are implementing our next growth strategy and Georgie will help us implement part of that strategy.

To connect with Georgie, drop her an email at georgie@arcandco.com

Welcome to the team Georgie!

Arc & Co. Secures £11.9m loan for London Development

Cameron Hayes, Arc & Co. has completed a loan for £11.9m secured a commercial site with planning for residential consent in South London.

The property is an existing retail site with planning for a mixed-use scheme comprising over 200 residential units and ground floor commercial.

It is the second deal that Arc&Co. has completed with Market Financial Solutions this quarter, totalling £25m of lending together.

Cameron Hayes, Asset Finance Advisor at Arc&Co. commented, “We are very pleased to get this one across the line. It’s the first development that will be brought forward by the client in this part of London. It neatly fits as part of the wider regeneration, coming relatively early within the new plans from Southwark and the GLA. We look forward to working with MFS and the client more over the coming months”.

Paresh Raja CEO, MFS says, “It was a pleasure working with Arc & Co on this deal. We were glad to be able to get this large mix-use loan completed quickly and seamlessly for the client. It’s very rewarding to work with brokers that really understand their clients. We look forward to our next cases with Arc & Co, making finance accessible for many more borrowers to come.”

Arc & Co. completes two loans with Century Capital

Arc & Co. have completed two residential bridging loans with Century Capital.

The first, a £2.1m second charge bridge on a prime residential apartment in Knightsbridge for a term of 18 months. The case involved complex KYC due to international origins. The purpose of the loan was equity release with a 66% LTV for business purposes.

The second loan, also equity release was a £1.5m senior bridge on a house in oxford for an overseas foreign national. The loan was 30% LTV for an 18 month term. The client had a complex income structure and funds were to finish refurbishment of the existing property.

Nikita Nigai says, “Both clients had reached out to various people in the market and weren’t satisfied with the options available to them. It was a pleasure to work alongside Century Capital who understood the client’s requirements and complete on both deals.”

Arc & Co. appoint Paul Davies as Regional Chairman, APAC

Arc & Co. are pleased to announce that Paul Davies, has been appointed Regional Chairman, APAC.

Paul has over 30 years experience in the financial services industry, having held senior positions at NatWest Bank and Coutts in the UK, in Switzerland, India and in Asia. For 15 years Paul was based in Singapore and was instrumental in building Coutts Bank’s Asian business which focused on High Net Worth (HNW) clients in Singapore, Malaysia, Indonesia and Thailand and Global Non-Resident Indians. His previous role was Vice Chairman of Coutts, Southeast Asia.

Since leaving Coutts, Paul focuses on providing strategic business development advice to companies in the Wealth Management and Philanthropic sectors. Paul is currently a Board Director at a Singapore charity AIDHA who help migrant domestic workers and low-income Singaporean women create sustainable futures through financial education.

Andrew Robinson says “Part of Arc & Co.’s growth strategy is to focus on regions around the world that have a direct influence on the UK and European real estate market. For many years, the APAC region has had a significant influence on these markets across all assets including residential, commercial and development. Paul’s depth of experience and reputation in the banking industry will help to guide Arc & Co.’s growth strategy and will be working closely with Sophie Brown who has been working with us for the past 10 months.”

Paul Davies says “I am delighted to be supporting Arc & Co. in the development of our business in Asia and also through my broader global network of contacts built up during the course of my career “

Arc & Co. secures £2.8m development facility for the development of 8 houses in West Finchley

Julian King, Director within the structured finance team at Arc & Co. has secured a £2.8m loan for his client, a Hong Kong based developer developing 8 houses in West Finchley. There were a number of constraints in completing the facility given the offshore structure of the borrower, as well as site constraints to include tight access and egress. The scheme itself is excellently located and well designed, providing attractive family housing on an otherwise derelict site.

Julian King says, “This is the second transaction I’ve been involved in with my client who is actively seeking development opportunities across London. The development of this site will be an excellent addition to their growing portfolio and I look forward to working with them throughout the lifecycle of the project”.

The £2.8m development loan was provided by Secure Trust Bank, to aid with the site purchase of the Former West Finchley Bowls Club and to deliver funding in which to construct the 8 houses, completing in Q2 2023. The loan provided by Secure Trust Bank was for 60% LTGDV priced at 5.99% p.a David Burke, Lending Director at Secure Trust Bank said “It was our first deal with the customer who was extremely well represented by Julian and Arc & Co, who also did a great job to supporting STB in manging the process to completion. We are always excited to be working with new to bank customers and we are looking forward to building this excellent scheme in Finchley together”.

Arc & Co. completes £11.5m loan to enable energy efficiency upgrades

Matthew Yassin, Director from the structured finance team at Arc & Co. has successfully secured a £11.5m loan with Interbay Commercial on mixed use office space in Lambeth. The purpose of the loan was equity release to cover costs incurred by improving the environmental standards of the building through installation of solar panel and a water harvesting system.

Interbay Commercial worked as the senior lender to provide a whole loan solution for the client at 87% against vacant possession value and 71% against investment value. The loan is a 10-year committed term with a fixed rate for the first 3 years that gives flexibility to the client.

Matthew Yassin, director for structured finance at Arc & Co (pictured above), said: “It’s extremely satisfying to be able to provide liquidity to support this ESG initiative, which has now become much more mainstream, as people are becoming more aware of the environmental impact that property has on its surroundings.”

The office space is an important part of Lambeth’s industrial heritage as it was the main factory for JA Sharwood & Co Ltd - a business that thrived locally and continued to thrive first with Rank Hovis McDougall and then Premier Foods. The site consists of 16 media offices, with a canteen, auditorium and studio space.

Arc & Co. secures £5.4m development facility for Farleigh, supporting their growth within central London

Julian King, Director within the structured finance team at Arc & Co. has secured a £5.4m loan to further support the growth of his clients Farleigh in their expansion within Central London. It is the third development that Arc & Co. have supported Farleigh on as they expand their output of developing residential lead schemes across London and the South East.

Julian King said, “It’s a pleasure working so closely with the team at Farleigh and to see their company grow from strength to strength. They have a very strong product in todays demanding residential market and know exactly how to deliver it on time and on budget, further proven by the record sales achieved on each of their sites”.

The £5.4m development loan was provided by HTB in under 6 weeks, to aid with the site purchase in the borough of Southwark and for the construction of 9 units. The development made up of 6 apartments and 3 town houses located within walking distance of the City and the mainline railway stations of London Bridge. The scheme has a GDV in excess of £8.5m and will complete in spring 2023.

Will Powell, Lending Director at HTB said “‘It is always a pleasure dealing with the team at Arc & Co. and our latest completion of a well-designed scheme of houses and flats for Farleigh is an excellent example of the quality of business in the market at the moment. Farleigh are a returning customer of the bank and the loan was drawn down under exacting time pressures owing to the structure of the purchase agreement.’

Arc & Co. continue to support the growth of Farleigh as they secure further sites to facilitate their 2022/23 pipeline, working together to meet their funding requirements to appropriately structure the funding required from their corporate strategy.

Robert Mulligan, co-founder of Farleigh said “Working with Arc & Co. has given us the confidence to build on our success in Bath and Bristol, and to focus on growth in London and the South East. Julian’s in-depth knowledge in development and structuring debt, coupled with his relationships in the lending market has enabled us to partner with some of the industry’s best lenders. We see them as an extended part of our own team, they know our model and how we like to structure things as well as having their finger very much on the pulse of the debt market which in the last few years has been a changing marketplace. We are looking forward to seeing this latest acquisition come out the ground Q1 2022.”

Arc & Co. complete their first loan with Bmor

Arc & Co. has completed a £1.4m acquisition loan for developers Bmor and Sam Burt Enterprises and lender, Atelier Capital Partners in Nottingham. The loan is to fund the purchase of a vacant 19th century school on which Bmor has recently obtained planning permission to convert and develop a 155-bedroom PBSA scheme.

Deal Outline:

• Loan size: £1.4m

• Lender: Atelier Capital Partners

• Asset: vacant school with planning permission to convert and develop out a 155-bed PBSA scheme

• Type of finance: Acquisition Bridge facility

• LTV: 55%

Deal Complexity

Bmor is currently involved in several development and regeneration schemes across Nottingham, including a vacant retail unit and 100 beds in Goosegate as well as the Heathcote Building in Hockley which is a 32,000 sq. ft. office refurbishment with ground floor retail. In terms of student schemes, Bmor recently executed a partnership agreement with Unite Students to redevelop a £34m, 270-bed student-led residential scheme in the city centre.

The scheme backing this transaction is the former Radford Boulevard School on Ilkeston Road which is another of Bmor’s joint ventures with local Nottingham developer, Sam Burt. Having recently obtained planning permission for a 155-bed PBSA scheme, the property will be regenerated to create a unique student scheme.

In terms of acquisition funding, Atelier were able to structure an equity release over and above the site acquisition cost which was an attractive element of the transaction.

Philip Kay, Senior Asset Finance Advisor at Arc & Co. says, “It was excellent to work with both Bmor and Atelier on completing this loan, which will be the first stage in achieving Bmor’s business plan for this excellent asset. As a business, we’ve known and followed Bmor for several years and are delighted to complete this transaction with them. We hope it will be the first of many.”

Paul Irwin Director of Bmor says, “It was a pleasure working with Arc & Co. and Atelier Capital Partners on this complex transaction. They understood the fundamentals of the student market well and enabled a smooth and swift transaction. We would be delighted to work with Arc & Co and Atelier on our future projects. We look forward to bringing this £20m GDV scheme to the market in due course.”

Arc & Co. completes a £10m Development Loan with Close Brothers

Arc & Co. has completed on a £10m pre planning development loan on the basis there was an existing asset with plans to develop prime houses in South East London with Close Brothers. The loan was value based of the existing use.

Key Points:

- Loan £9.98m

- LTC 85%

- Located in South East London

Matthew Yassin at Arc & Co. commented “Once the lender was engaged, the deal took 8 weeks to completed from start to finish, with excellent communication from both Client and Lender enabling a smooth transaction. The key factors for this to get over the line were very much the expertise of the lender, the approach and understanding from the client’s side who was a pleasure to work with.

The main obstacles with this project were centred on the delays within the planning department and the client was under pressure from the vendor to complete. The lender took a pragmatic approach and was happy to complete prior to planning being sanctioned based on the strength and experience of the client.”

Laura Metcalfe at Close Brothers commented “The excellent communication between us, the Client, Broker and our solicitors ensured we were able to complete this deal within the required timescales. Matthew at Arc & Co provided a full appraisal and was upfront about the quirks of the deal, which enabled us to provide reassurances early on that this was something we could assist with.

With planning due imminently, we are looking forward to building our relationship with both the Broker and the Client and look forward to seeing this development take shape over the coming months.”

Arc & Co. completes £12m commercial refinance with Market Financial Solutions

Arc & Co. has completed on a £12m bridge loan secured against commercial property with planning consent for residential in Greater London.

Key Points:

-Lender: Market Financial Solutions (MFS)

-Loan Amount: £12.3m

-Term Length: 12 months

-Loan-To-Value: 70%

Edward Horn-Smith at Arc & Co. commented; “The client required a funding solution to refinance existing debt and provide time to enable sale of the property. After a short tender process we sought MFS as the best suited counter party. They executed on the terms agreed from the offset.”

Imogen Williams, Regional Sales Manager from MFS stated: “Arc & Co discussed a proposition with us that had huge potential and a thorough briefing. After reviewing the information and agreeing the deal at credit, we then worked with Ed and the team to get it over the line as swiftly as possible. Elements of the deal changed within the term through no fault of anyone involved however, we decided to honour our all our agreements from the start of the transaction.

Richard D’Souza, Underwriting Manager from MFS added: “The logistics of the case can change during the process. When this happens, transparency and clear communication from both sides is essential to avoid confusion and ensure the process continues smoothly. We worked closely with Arc & Co on this case to ensure their client was kept informed and updated – as well as working quickly to ensure they received the funds they needed.”

Arc & Co. grows its Structured Finance team

Oliver Holden has joined Arc & Co. after having spent the past 7 years working for the commercial debt advisory team at SPF Private Clients, focussing on financing real estate across a variety of sectors including logistics/industrials, residential, student, office, hotel and retail.

Oliver says, “I’m excited to be joining the excellent team at Arc & Co. and to be part of their award-winning advisory service which stands as one of the very best in a congested and competitive space”

Andrew Robinson says, “We are excited to have Oliver working with Arc & Co. He brings vast experience and industry knowledge which will add value to Arc & Co. and our clients.”

The recent appointment of James Fleming as Chairman is giving Arc & Co. the direction, strategy and structure to attract the best advisors which is needed to progress Arc & Co,’s position in the market. The competition in the market is becoming stronger and stronger which is great for the consumer as Advisory standards will continue to increase.

To connect with Oliver, drop him an email at Oliver@arcandco.com. Welcome to the team!